Retail remains the leading sector for Malaysian commercial investment in 2018

Contact

Retail remains the leading sector for Malaysian commercial investment in 2018

According to Knight Frank Malaysia's Commercial Real Estate Investment Sentiment Survey 2018.

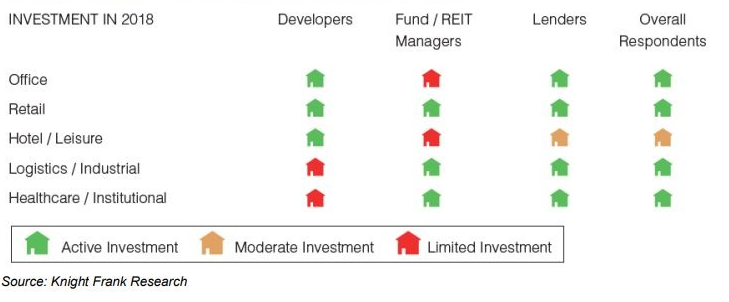

Malaysia's retail sector ranked top amongst the key players in the commercial real estate investment sentiment survey. All players, namely, Developers, Fund / REIT Managers and Lenders indicate that they will continue to invest/fund the property sub-sector despite the oversupplied market. Whilst the Retail, Office and Hotel / Leisure sub-sectors will continue to see investments from Developers; Fund / REIT Managers are looking to invest in the Retail, Logistics / Industrial, and Healthcare / Institutional sub-sectors.

Sectors attracting investment from commercial real estate investors in 2018

Rebecca Phan, Associate Director of Retail Consultancy and Leasing, Knight Frank Malaysia says, “Malaysia’s retail industry will continue to play a formidable role in our nation’s commercial property market. The outlook for the retail market, however, does not look rosy in 2018 as an immediate rebound in consumer spending is highly unlikely. This phenomenon may be alleviated if proper measures are enacted to prevent new retail developments flooding the market. Besides that, existing retail properties should retool themselves in order to maintain their relevance in the eyes of patrons.

“Despite the unfavourable sentiment surrounding the retail market, the sector will continue to attract investments as developers are expected to collaborate with experienced mall managers to enhance the attractiveness of their assets and remain competitive in the challenging operating environment. In the current retail landscape, mall operators need to focus beyond the occupancy rate of malls as high occupancy rates no longer constitute to high profitability.”

Rebecca Phan adds, “Mall operators should place more emphasis towards developing technologies and marketing tools, which will stir consumers to open up their wallets. This can come in the form of social media marketing, campaigns, or workshops dedicated to encouraging shoppers to try out products by tenants. Also, it has become more common for mall operators to utilize food and beverage operators to act as crowd pullers to increase the footfall of their malls. However, it is worth noting there is a need to maintain a balanced tenant mix in order to generate a conducive retail experience for consumers. Therefore, food and beverage operators shall not occupy more than 35% of a mall’s net lettable area (NLA). Moreover, malls in Malaysia have now become a one-stop destination for families.

Hence, tenant mix in a mall shall be diverse enough to cater to patrons of different age groups.”

The retail sub-sector has a rather muted performance in 2017. This is attributed to the synchronised decline in sales suffered by merchants across different sectors. Moreover, the Consumer Sentiments Index (CSI) stood at 82.6 points (Source: Malaysian Institute of Economic Research, MIER), which is still below the 100-point threshold. This indicates a continued lack of confidence among consumers.

Hence, the outlook remains bleak as consumers continue to be prudent about their spending habits. On the other hand, competition among retailers remains stiff as merchants attempt to outdo each other in order to generate sales. However, in the process of outmanoeuvring each other via promotions and discounts, retailers will cut into their own margins. Furthermore, the presence of more shopping malls flooding the market, with similar offering of goods and services, will further dilute the market. Hence, retailers are expected to continue operating in a very challenging environment.

Click here to download the Malaysia Commercial Real Estate Investment Sentiment Survey 2018.

Source: Knight Frank Malaysia

Similar to this:

"Malaysia property market continues to self-correct" says Sarkunan Subramaniam, Managing Director of Knight Frank Malaysia

Architecturally-designed penthouse in One KL, Jalan Pinang, Malaysia

Live the high life in 18 East at Andaman's splendid ocean-view penthouse